"We shall have to repent in this generation, not so much for the evil deeds of the wicked people, but for the appalling silence of the good people." ~ Martin Luther King, Jr.

Sunday, July 31, 2011

Saturday, July 30, 2011

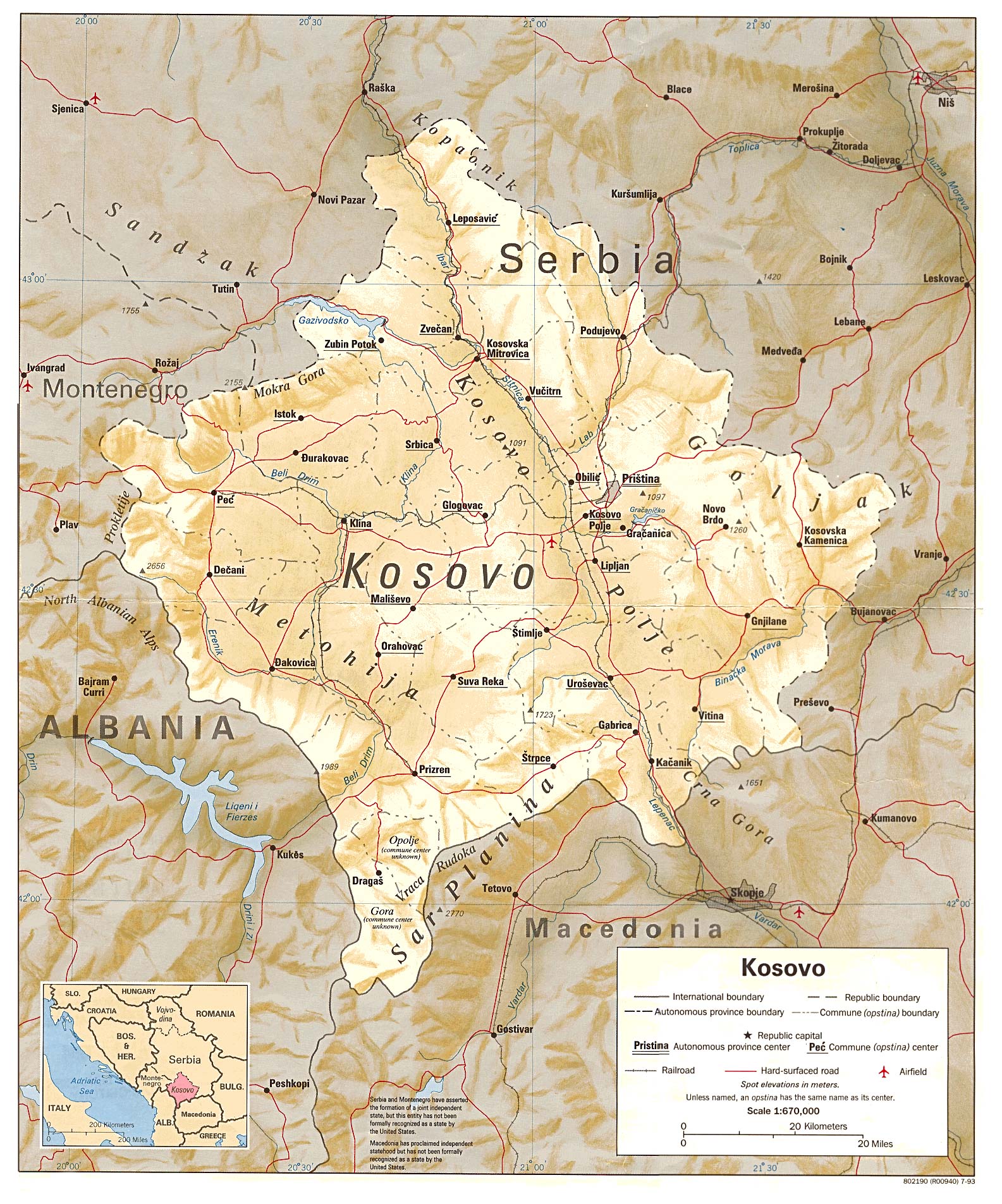

Kosovo Border Offensive Against Serbia

As of recent, Kosovo has launched a border offensive against Serbia, yet there aren’t many reports of it within the mainstream news about this ongoing situation.

The situation began just four days ago, on July 26th, when the Kosovo Prime Minister sent “lightly armed special police units” into Serbia to begin “an operation aimed at placing troops loyal to [Kosovo] in a region that takes orders from Serbia.” The region in question is being used by Serbia in its “ongoing campaign to undermine Kosovo's 2008 secession.” [1] By controlling this region, the Kosovos also planned to “enforce a ban on goods from Serbia to counter years of a similar boycott by Belgrade in response to Kosovo's 2008 secession.”

This move by Kosovo prompted condemnation from the US and the European Union, as well as an attack on a border crossing between Kosovo and Serbia, as ethnic Serbs protested Kosovo’s attempts to take control of the border. [2] The very next day, NATO forces intervened in the Kosovo-Serbia dispute, trying to calm both sides.

NATO troops were deployed, yet in just a few days they “made a tactical retreat in Kosovo as ethnic Serbs stopped them reaching peacekeepers deployed at border posts with Serbia after a customs dispute turned violent.” [3]

At the heart of this entire conflict is Kosovo’s sovereignty. Serbia sees Kosovo “as its southern province, rejects all imports bearing the symbol of the Kosovo state, as well as travelers coming from Kosovo.” [4] By responding in kind, Kosovo is sending the message that they are a sovereign nation and should be treated as such.

However, in reality, Kosovo is not internationally recognized as a state.

Without a doubt, some type of deal is going to have to be struck, as the Kosovos want their independence while the Serbs want to keep territory.

Endnotes

Friday, July 29, 2011

Idiots On My Left, Crazies On My Right: Why America Needs A Viable Third Party

The US is currently in a standstill with the debt crisis. The Republicans are using it to slash the social safety net, thus hurting the poor, students, and senior citizens in order to give tax cuts to the rich and fund massive wars and the Democrats are going right along with it. We are in a situation where there are idiots to our left and crazies to our right, which is why a third party is needed.

As of recent, the Republicans are arguing that there be no taxes in the debt ceiling deal, while they want to enact major social spending cuts to programs like Medicare, Medicaid, and Social Security. The right has been lying that Social Security is bankrupt when in reality; it is solvent until 2037 (see this as well). The idiot Democrats have been going right along with these crazies, with Harry Reid arguing for a $2.7 trillion cut in spending with no tax increases and President Obama is so stupid (or so much of a corporate shill) that he is also backing this proposal.

It is fully acknowledged that both parties do not care about the US citizens, much less the country as a whole (one only need to see the bickering over the debt ceiling to realize this). Thus, the only way to end to two party plutocracy is to have a third party. However, this third party is to be truly unique. They will not take corporate funding and will truly look out for the American people by endorsing such plans as the Congressional Progressive Caucus’s People’s Budget, which “eliminates the deficit in 10 years, puts Americans back to work and restores our economic competitiveness.”

This new third party, due to not being bought by corporate interests, would be able to run candidates that were actually a part of ordinary Americans instead of from the elite and would bring about more citizen involvement in politics, as people would pressure the members of the third party to stay true to their promises, seeing as how they can much more relate to the third party candidate.

We’ve been trying to two party system for over 100 years. Isn’t it time we try something different?

Thursday, July 28, 2011

Wednesday, July 27, 2011

Monday, July 25, 2011

UPDATE: Harvard's Aaron Swartz indicted on MIT hacking charges by Richard Adams

For more info, here is an article by Wired.com the day the story broke.

This article was originally published by The Guardian on July 21, 2011

This article was originally published by The Guardian on July 21, 2011

A self-styled digital Robin Hood downloaded more than 4 million academic articles before being tracked down by US authorities in a case that promises to become a cause célèbre for data use and freedom of information.

A grand jury in Massachusetts has indicted Aaron Swartz, a 24-year-old programmer and fellow at Harvard University's Safra Centre for Ethics, on charges of wire and computer fraud for his marathon downloading spree.

The indictment also alleges that Swartz caused damage of at least $5,000 (£3,000) to computers and unlawfully obtained information over more than three months while he was copying the huge cache of articles from the database of Jstor, the giant US-based online academic repository.

Starting with a standard Acer laptop, Swartz began by using anonymous log-ins on the network of the Massachusetts Institute of Technology (MIT) in September 2010. As the size of his downloads began to alarm MIT and Jstor staff they kept trying to block Swartz's access – only for the 24-year-old to evade their attempts using simple techniques to disguise his log ins and mask his computer.

In desperation, Jstor eventually blocked the entire MIT network from access to its vast database for several days in October 2010 – cutting off one of the world's premier research universities from the millions of scientific journals and academic articles Jstor holds.

But even then, the talented coder is alleged to have bypassed them completely by entering a restricted network interface room on MIT's campus and wiring his equipment directly to its network.

According to the indictment, at one point Swartz's downloads were bringing down some of Jstor's servers: "This was more than 100 times the number of downloads during the same period by all the legitimate MIT Jstor users combined.

If convicted Swartz faces maximum jail terms of 35 years and possible fines of up to $1m. Swartz appeared in court on Wednesday and was released on bail of $100,000.

Harvard University said it had placed Swartz on leave for the remainder of his fellowship.

Swartz is a well-known digital activist, the founder of online group Demand Progress and for being a brilliant programmer. His arrest set off a war of metaphors between the federal authorities and his supporters over what it is exactly that Swartz planned to do with the trove of 4.8m articles.

The indictment filed in the US district court in Massachusetts said: "Swartz intended to distribute a significant portion of Jstor's archive of digitised journal articles through one of more filesharing sites."

US attorney Carmen Ortiz said: "Stealing is stealing, whether you use a computer command or a crowbar, and whether you take documents, data or dollars. It is equally harmful to the victim whether you sell what you have stolen or give it away."

Swartz's defenders correctly reply that copying files – especially from publicly available research databases – cannot be equated with stealing.

"It's like trying to put someone in jail for allegedly checking too many books out of the library," said David Segal, the executive director of Demand Progress, in a statement after Swartz was charged.

According to Demand Progress, MIT has already reached a settlement with Swartz, while Jstor said: "We secured from Mr Swartz the content that was taken, and received confirmation that the content was not and would not be used, copied, transferred, or distributed."

That has left some observers puzzled as to why the federal prosecutors have gone ahead with the case, especially as Jstor – the most obvious victim in the affair – publicly announced: "Our interest was in securing the content. Once this was achieved, we had no interest in this becoming an ongoing legal matter."

The other mystery is what Swartz may have been planning to do with the huge cache of PDF documents.

In 2009, Swartz attracted the attention of the FBI after he legally downloaded about 20m pages of court documents from the federal judiciary and distributed them free across the internet.

Demand Progress launched an online petition backing Swartz and received more than 40,000 messages of support.

US Debt Crisis Still Unresolved

August 2nd is only eight days away and the US government still has not reached a budget deal. This could cause serious problems not only for the American people, but also for the financial institutions as well.

Currently, emerging-market stocks (definition of emerging market here) are currently declining “as a stalemate over increasing the U.S. debt limit raised concerns of a default that could threaten the global recovery.” This has a serious effect on US markets, as can be seen by the fact that “The Standard & Poor’s 500 Index retreated 0.3 percent after falling as much as 1 percent.”

Things may get worse as there doesn’t seem to be much hope, with each side having rival debt plans. The Republican Speaker of the House, John Boehner, is imagining “an increase in the nation's debt limit by $1 trillion and slightly more than that in federal spending cuts, with the promise of additional progress on both sides of the ledger if Congress could agree,” while Democratic Senator Harry Reid is “at work on legislation to raise the government's debt limit by $2.4 trillion — enough to assure no recurrence of the current crisis until 2013 — and reduce spending by slightly more.”

In addition to this, Americas should be worried as the IMF has told the US “to resolve its debt crisis amid warnings from one of the world's most influential investors that the country risked losing its triple-A credit rating within months because of the reputational damage caused by the ongoing disagreement over the debt ceiling.” Also, a bond chief has warned that America’s triple-A credit rating is in danger.

One important item of both plans that should be noted is that neither plan considered increasing taxes. While this is just the Republicans towing the party line, for the Democrats, they are selling out and throwing in the towel. The essential problem with the debt is that US has both a spending and a revenue problem (see this and this as well), thus in order to balance the budget, America needs to cut spending and increase taxes.

Overall, the main problem is that both parties are blaming one another even though Americans favor compromise. Once again, both parties are showing that they care more about party politics than the business of saving the country from economic destruction.

Currently, emerging-market stocks (definition of emerging market here) are currently declining “as a stalemate over increasing the U.S. debt limit raised concerns of a default that could threaten the global recovery.” This has a serious effect on US markets, as can be seen by the fact that “The Standard & Poor’s 500 Index retreated 0.3 percent after falling as much as 1 percent.”

Things may get worse as there doesn’t seem to be much hope, with each side having rival debt plans. The Republican Speaker of the House, John Boehner, is imagining “an increase in the nation's debt limit by $1 trillion and slightly more than that in federal spending cuts, with the promise of additional progress on both sides of the ledger if Congress could agree,” while Democratic Senator Harry Reid is “at work on legislation to raise the government's debt limit by $2.4 trillion — enough to assure no recurrence of the current crisis until 2013 — and reduce spending by slightly more.”

In addition to this, Americas should be worried as the IMF has told the US “to resolve its debt crisis amid warnings from one of the world's most influential investors that the country risked losing its triple-A credit rating within months because of the reputational damage caused by the ongoing disagreement over the debt ceiling.” Also, a bond chief has warned that America’s triple-A credit rating is in danger.

One important item of both plans that should be noted is that neither plan considered increasing taxes. While this is just the Republicans towing the party line, for the Democrats, they are selling out and throwing in the towel. The essential problem with the debt is that US has both a spending and a revenue problem (see this and this as well), thus in order to balance the budget, America needs to cut spending and increase taxes.

Overall, the main problem is that both parties are blaming one another even though Americans favor compromise. Once again, both parties are showing that they care more about party politics than the business of saving the country from economic destruction.

Sunday, July 24, 2011

Friday, July 22, 2011

The Fed Audit

This article was originally posted on Senator Bernie Sanders' website on July 21, 2011.

The first top-to-bottom audit of the Federal Reserve uncovered eye-popping new details about how the U.S. provided a whopping $16 trillion in secret loans to bail out American and foreign banks and businesses during the worst economic crisis since the Great Depression. An amendment by Sen. Bernie Sanders to the Wall Street reform law passed one year ago this week directed the Government Accountability Office to conduct the study. "As a result of this audit, we now know that the Federal Reserve provided more than $16 trillion in total financial assistance to some of the largest financial institutions and corporations in the United States and throughout the world," said Sanders. "This is a clear case of socialism for the rich and rugged, you're-on-your-own individualism for everyone else."

Among the investigation's key findings is that the Fed unilaterally provided trillions of dollars in financial assistance to foreign banks and corporations from South Korea to Scotland, according to the GAO report. "No agency of the United States government should be allowed to bailout a foreign bank or corporation without the direct approval of Congress and the president," Sanders said.

The non-partisan, investigative arm of Congress also determined that the Fed lacks a comprehensive system to deal with conflicts of interest, despite the serious potential for abuse. In fact, according to the report, the Fed provided conflict of interest waivers to employees and private contractors so they could keep investments in the same financial institutions and corporations that were given emergency loans.

For example, the CEO of JP Morgan Chase served on the New York Fed's board of directors at the same time that his bank received more than $390 billion in financial assistance from the Fed. Moreover, JP Morgan Chase served as one of the clearing banks for the Fed's emergency lending programs.

In another disturbing finding, the GAO said that on Sept. 19, 2008, William Dudley, who is now the New York Fed president, was granted a waiver to let him keep investments in AIG and General Electric at the same time AIG and GE were given bailout funds. One reason the Fed did not make Dudley sell his holdings, according to the audit, was that it might have created the appearance of a conflict of interest.

To Sanders, the conclusion is simple. "No one who works for a firm receiving direct financial assistance from the Fed should be allowed to sit on the Fed's board of directors or be employed by the Fed," he said.

The investigation also revealed that the Fed outsourced most of its emergency lending programs to private contractors, many of which also were recipients of extremely low-interest and then-secret loans.

The Fed outsourced virtually all of the operations of their emergency lending programs to private contractors like JP Morgan Chase, Morgan Stanley, and Wells Fargo. The same firms also received trillions of dollars in Fed loans at near-zero interest rates. Altogether some two-thirds of the contracts that the Fed awarded to manage its emergency lending programs were no-bid contracts. Morgan Stanley was given the largest no-bid contract worth $108.4 million to help manage the Fed bailout of AIG.

A more detailed GAO investigation into potential conflicts of interest at the Fed is due on Oct. 18, but Sanders said one thing already is abundantly clear. "The Federal Reserve must be reformed to serve the needs of working families, not just CEOs on Wall Street."

To read the GAO report, click here.

Greed, Neocolonialism, and Social Destruction: A History of the International Monetary Fund

The International Monetary Fund (IMF) has wreaked havoc on third world nations, burdening them with crushing debts and then forcing governments to enact massive austerity measures on their own people as to allow Western corporations to move in and exploit the newfound resources and cheap labor. While many know of the IMFs infamous policies, the origins of this tool of neocolonialism also should be examined.

World War 2 and Bretton Woods

Due to the protectionist policies that occurred during the period of the Great Depression, the founders of the IMF wanted to create a global economic organization that would “ensure exchange rate stability and encourage its member countries to eliminate exchange restrictions that hindered trade.” [1] In addition to the Great Depression, “socialists, communists and anarchists had high credibility [at the end of WW2] because they were the leaders of the Resistance to Nazi occupation,” [2] which had American and British economic elites worried. Thus, in order to make sure that leftists didn’t come into power and to back the business classes, the US and British “required international institutions that would promote capitalist policies and strengthen the power of the corporate sector” [3] which became the IMF and the World Bank.

The IMF was created at the Bretton Woods Conference near the end of WW2. The main debate during the conference was as to what role the IMF would play. The British “imagined that the new IMF should be a cooperative fund which member states could draw upon to maintain economic activity and employment through periodic crises” whereas the Americans “foresaw an IMF more like a bank, making sure that borrowing states could repay their debts on time.” [4] While the US version won out in the end, it didn’t truly matter as either way; the IMF would be a tool to promote global capitalism, as can be seen in Article 1, Section 2 of the IMF’s Articles of Agreement. One of the purposes of the IMF was to

facilitate the expansion and balanced growth of international trade, and to contribute thereby to the promotion and maintenance of high levels of employment and real income and to the development of the productive resources of all members as primary objectives of economic policy. [5]

By working toward “the expansion and balanced growth of international trade” it can be seen, in the context of a post-WW2 world that the US wanted to be able to flood the markets of Europe and Asia with its goods and the only way American corporations could make money from nations that had been destroyed by war was if there was a “maintenance of high levels of employment and real income.” Thus, in reality, a major reason the IMF was created was to give US companies a way to increase their profits

Bretton Woods System Collapses

The Bretton Woods system collapsed in 1971 when US President Richard Nixon took America off the gold standard. While there are stories that Nixon took the US off to gold standard as to “prevent a run on Fort Knox, which contained only a third of the gold bullion necessary to cover the amount of dollars in foreign hands,” [6] there were other factors at play.

The gold standard was a problem for both the US government and the American financial industry due to the fact that “the amount of credit that an economy can support is determined by the economy's tangible assets, since every credit instrument is ultimately a claim on some tangible asset,” thus “government bonds are not backed by tangible wealth, only by the government's promise to pay out of future tax revenues, and cannot easily be absorbed by the financial markets” [7] thus the government’s deficit spending was severely limited. By scrapping the gold standard, it allows for financial institutions “to use the banking system as a means to an unlimited expansion of credit” [8] and indefinitely increases the money supply. However, there are drawbacks:

As the supply of money (of claims) increases relative to the supply of tangible assets in the economy, prices must eventually rise. Thus the earnings saved by the productive members of the society lose value in terms of goods. [9]

While the bankers are able to get more money off of their loan transactions, ordinary Americans would suffer via inflation, seeing their wages and salaries buying less and less.

Mexico Crisis and Structural Adjustment Policies

In 1982, the Mexican government alerted the IMF that it was unable to pay back its debts. Immediately, the IMF and World Bank came in and allowed Mexico to borrow more money to pay off the interest on the old debt. The reason this occurred was due to the fact that Mexico owed the US and Europe large sums of money and they didn’t want to lose it. However, there were strings attached to Mexico’s new loans, known now as Structural Adjustment Policies (or Plans). These usually force indebted governments to

- Spend less on health, education and social services - people pay for them or go without

- Devalue the national currency, lowering export earnings and increasing import costs

- Cut back on food subsidies - so prices of essentials can soar in a matter of days

- Cut jobs and wages for workers in government industries and services

- Encourage privatization of public industries, including sale to foreign investors

- Take over small subsistence farms for large-scale export crop farming instead of staple foods. So farmers are left with no land to grow their own food and few are employed on the large farms. [10]

Essentially, these austerity measures that are enacted destroy the middle and working classes as well as their social safety net and allow Western corporations to move in and exploit labor and resources for their personal profit.

The overall problem with Mexico and other countries that the IMF loans to in circumstances such as these is that they “essentially postponed the debt crisis by providing short term funds on very hard terms for what was essentially a structural problem of insolvency which required long-term solutions.” [11] It is quiet like what the US government has been doing for decades by raising the debt ceiling, while doing nothing to combat the root causes of the debt problem. In ‘aiding’ Mexico, the IMF was going along with the Washington Consensus which essentially called for the economies of indebted nations to go through neo-liberal economic reforms, which would, as was said earlier, allow for the destruction of the middle and working classes and for Western corporations to come in and dominate the nation’s economy.

End of the Cold War

At the end of the Cold War, the Soviet Union collapsed and several nations in Eastern Europe were soon created. While IMF was forcing its shock therapy onto Russia, they were busy engineering an economic crisis in Asia.

The Asian economic crisis of the 1990s came about due to “South Korea, Thailand, the Philippines, Malaysia and Indonesia's heavy reliance on short-term foreign loans and openness to hot money,” [12] openness that came from the US Treasury Department, the IMF, and others.

In 1997, it became obvious that the Asian governments wouldn’t be able to pay back their loans and investors panicked, exchanging their Asian currencies for dollars, thus making it more difficult for Asian nations to pay off their debt and greatly increasing the price of imported goods.

The IMF stepped in and allowed governments to borrow money to pay off their loans- with the usual structural adjustment policies of course. Strangely enough, even though the Asian economies were running budget surpluses, the IMF ordered them to cut spending, this only helped to deepen the economic slowdown.

Due to the IMF’s ignorant buffoonery, countless people suffered:

- In South Korea, a country whose income approaches European levels, unemployment skyrocketed from approximately 3 percent to 10 percent. "IMF suicides" became common among workers who lost their jobs and dignity.

- In Indonesia, the worst hit country, poverty rates rose from an official level of 11 percent before the crisis to 40 to 60 percent in varying estimates. GDP declined by 15 percent in one year.

- In September 1998, UNICEF reported that more than half the children under two years old in Java, Indonesia's most populous island, were suffering from malnutrition.

- At one point, the food shortage became so severe that then-President B.J. Habibie implored citizens to fast twice a week. Many had no choice. (emphasis added) [13]

Could the IMF Turn on the West?

Since its inception, the IMF has been used as a tool of neocolonialism by Western governments to rape and pillage the third world. However, due to the massive debts that Western governments have incurred, the IMF may, in an ironic twist of fate, turn on the very governments that created it.

Just last year, the IMF did an annual economic review of American economic policy, which is something they only do to third-world countries. While there are those that state that the $4 trillion fiscal gap is due to entitlement programs, such as Social Security, Medicare, and Medicaid, they are quiet wrong. The reality is that they are, for the most part, doing well. The problems are the wars in Iraq and Afghanistan. "The ongoing wars and occupations have already eaten up the $4 trillion by which Obama hopes to cut federal spending over the next ten years. Bomb now, pay later." (emphasis added) [14]

Currently the IMF is arguing for the US government to make cuts to Social Security in order to get its budget deficit down and it looks like the Republicans want to implement that plan and more while the Democrats quietly look on.

The IMF is a horrible organization that has been used for neocolonial purposes for decades, however, it may soon be time where the Western countries end up getting a taste of their own medicine. Then we’ll see if the Western governments will be so supportive of the IMF as they are now.

Endnotes

1: http://www.imf.org/external/about/images/histcoop.gif

2: http://www.globalexchange.org/campaigns/wbimf/origins.html

3: Ibid

4: http://ucatlas.ucsc.edu/sap/history.php

5: http://www.imf.org/external/pubs/ft/aa/aa01.htm

6: http://www.time.com/time/business/article/0,8599,1852254,00.html

7: http://www.321gold.com/fed/greenspan/1966.html

8: Ibid

9: Ibid

10: http://www.jubileeusa.org/resources/debt-resources/beginners-guide-to-debt/how-it-all-began.html

11: http://www.chebucto.ns.ca/Current/P7/bwi/cccbw.html

12: http://www.essentialaction.org/imf/asia.htm

13: Ibid

14: http://globalresearch.ca/index.php?context=va&aid=25732

2: http://www.globalexchange.org/campaigns/wbimf/origins.html

3: Ibid

4: http://ucatlas.ucsc.edu/sap/history.php

5: http://www.imf.org/external/pubs/ft/aa/aa01.htm

6: http://www.time.com/time/business/article/0,8599,1852254,00.html

7: http://www.321gold.com/fed/greenspan/1966.html

8: Ibid

9: Ibid

10: http://www.jubileeusa.org/resources/debt-resources/beginners-guide-to-debt/how-it-all-began.html

11: http://www.chebucto.ns.ca/Current/P7/bwi/cccbw.html

12: http://www.essentialaction.org/imf/asia.htm

13: Ibid

14: http://globalresearch.ca/index.php?context=va&aid=25732

UN Green Helmets?

The UN Security Council is now “examining whether a green helmet force should intervene in conflicts caused by rising seas levels and shrinking resources” [1] and climate change in general. This, coupled with UN Secretary-General Ban Ki-Moon’s statement that the goal of his second term was to encourage “global development that reduces poverty but preserves the environment for future generations,” [2] raises the question of what would occur if the UN did in fact establish a climate change peacekeeping force and if the UN is overstepping its boundaries.

The UN does have an argument that climate change is going to affect the world. In 2009, Mr. Ki-Moon “identified sea-level rise as the ‘ultimate security threat’ for some small island states, with some possibly set to disappear over the next 30 years’” which could lead to “disputes over maritime territories and access to exclusive economic zones.” [3] This could have far-reaching effects as

Uncoordinated strategies aiming to cope with forced migration as a consequence of sea-level rise may create social and political tensions, which may derail efforts in peacebuilding and post-conflict stabilization – and thus become a threat to international peace and security. [4]

This concern about rises in sea level has created a battle between large nations and small island nations. For example, China “argues that the security council should leave climate change to the experts” while small island nations “in the Pacific, which face an existential threat due to climate change, have been pushing the council to act for years.” [5]

President of Nauru (see this, this and this, for information on Nauru), Marcus Stephen, stated that due to the rise in sea levels in recent years “Nauru’s coast, the only habitable area, is steadily eroding, and communities in Papua New Guinea and the Solomon Islands have been forced to flee their homes to escape record tides.” [6] While large nations may not seem to care, they should be worried as it has generally been predicted that climate change could lead to general strife in countries and that it could potentially have wide-reaching effects and force its neighbors to intervene.

There is also debate over whether the UN is overstepping its boundaries. For example, some speculate the UN troops could end up on US soil, stating the that UN intervening in climate change

would give [them] justification to place a "peacekeeping" force on U.S. soil, of course. Virtually the entire U.S. Southeast -- from Texas all the way to D.C. -- is currently sweltering under a severe heat wave combined with a hundred-year drought in many areas. Under the UN's new "climate change peacekeeping" initiatives, if crop failures result in riots, they could drop in a few hundred thousand UN troops -- all wearing GREEN helmets -- and then explain they're here to save us from "conflicts caused by shrinking resources. [7]

However, others argue that it won’t do much harm as “UN blue-helmeted peacekeepers are pretty much helpless wherever they are deployed so you might ask will changing the color of their helmets alter that reality?” [8]

Overall, it is the UN that will have to answer the question of whether or not they want to intervene in the problems that are caused by climate change. However, there is another option besides the UN green helmets and that is to take a stand against climate change, to begin implementing policies that will help us deal with it in the short-term and create a greener way of life in the long-term.

Endnotes

1: http://www.huffingtonpost.com/2011/07/20/un-green-helmets_n_904503.html

2: http://www.huffingtonpost.com/huff-wires/20110719/un-un-secretary-general-second-term

3: http://www.new-york-un.diplo.de/Vertretung/newyorkvn/en/__pr/Press_20releases/PM__2011/110719_20Impact_20of_20Climate_20Change.html?archive=2990092

4: Ibid

5: http://www.guardian.co.uk/environment/2011/jul/20/un-climate-change-peacekeeping?intcmp=122

6: http://www.nytimes.com/2011/07/19/opinion/19stephen.html?_r=2&ref=opinion\

7: http://www.naturalnews.com/033076_United_Nations_peacekeeping.html

8: http://www.americanthinker.com/blog/2011/07/are_you_ready_for_the_uns_green_helmets.html

2: http://www.huffingtonpost.com/huff-wires/20110719/un-un-secretary-general-second-term

3: http://www.new-york-un.diplo.de/Vertretung/newyorkvn/en/__pr/Press_20releases/PM__2011/110719_20Impact_20of_20Climate_20Change.html?archive=2990092

4: Ibid

5: http://www.guardian.co.uk/environment/2011/jul/20/un-climate-change-peacekeeping?intcmp=122

6: http://www.nytimes.com/2011/07/19/opinion/19stephen.html?_r=2&ref=opinion\

7: http://www.naturalnews.com/033076_United_Nations_peacekeeping.html

8: http://www.americanthinker.com/blog/2011/07/are_you_ready_for_the_uns_green_helmets.html

Thursday, July 21, 2011

Somalia: The Real Causes of Famine by Michel Chossudovsky

This article was originally published Global Research on July 21, 2011.

The IMF Intervention in the Early 1980s

Somalia was a pastoral economy based on "exchange" between nomadic herdsmen and small agriculturalists. Nomadic pastoralists accounted for 50 percent of the population. In the 1970s, resettlement programs led to the development of a sizeable sector of commercial pastoralism. Livestock contributed to 80 percent of export earnings until 1983. Despite recurrent droughts, Somalia remained virtually self-sufficient in food until the 1970s.

The IMF-World Bank intervention in the early 1980s contributed to exacerbating the crisis of Somali agriculture. The economic reforms undermined the fragile exchange relationship between the "nomadic economy" and the "sedentary economy" - i.e. between pastoralists and small farmers characterized by money transactions as well as traditional barter. A very tight austerity program was imposed on the government largely to release the funds required to service Somalia's debt with the Paris Club. In fact, a large share of the external debt was held by the Washington-based financial institutions.' According to an ILO mission report:

[T]he Fund alone among Somalia's major recipients of debt service payments, refuses to reschedule. (...) De facto it is helping to finance an adjustment program, one of whose major goals is to repay the IMF itself.

Towards the Destruction of Food Agriculture

The structural adjustment program reinforced Somalia's dependency on imported grain. From the mid-1970s to the mid-1980s, food aid increased fifteen-fold, at the rate of 31 percent per annum.' Combined with increased commercial imports, this influx of cheap surplus wheat and rice sold in the domestic market led to the displacement of local producers, as well as to a major shift in food consumption patterns to the detriment of traditional crops (maize and sorghum). The devaluation of the Somali shilling, imposed by the IMF in June 1981, was followed by periodic devaluations, leading to hikes in the prices of fuel, fertilizer and farm inputs. The impact on agricultural producers was immediate particularly in rain-fed agriculture, as well as in the areas of irrigated farming. Urban purchasing power declined dramatically, government extension programs were curtailed, infrastructure collapsed, the deregulation of the grain market and the influx of "food aid" led to the impoverishment of farming communities.'

Also, during this period, much of the best agricultural land was appropriated by bureaucrats, army officers and merchants with connections to the government.' Rather than promoting food production for the domestic market, the donors were encouraging the development of so-called "high value-added" fruits, vegetables, oilseeds and cotton for export on the best irrigated farmland.

Collapse of the Livestock Economy

As of the early 1980s, prices for imported livestock drugs increased as a result of the depreciation of the currency. The World Bank encouraged the exaction of user fees for veterinarian services to the nomadic herdsmen, including the vaccination of animals. A private market for veterinary drugs was promoted. The functions performed by the Ministry of Livestock were phased out, with the Veterinary Laboratory Services of the ministry to be fully financed on a cost-recovery basis. According to the World Bank:

Veterinarian services are essential for livestock development in all areas, and they can be provided mainly by the private sector. (... Since few private veterinarians will choose to practice in the remote pastoral areas, improved livestock care will also depend on "para vets" paid from drug sales.'

The privatization of animal health was combined with the absence of emergency animal feed during periods of drought, the commercialization of water and the neglect of water and rangeland conservation. The results were predictable: the herds were decimated and so were the pastoralists, who represent 50 percent of the country's population. The "hidden objective" of this program was to eliminate the nomadic herdsmen involved in the traditional exchange economy. According to the World Bank, "adjustments" in the size of the herds are, in any event, beneficial because nomadic pastoralists in sub-Saharan Africa are narrowly viewed as a cause of environmental degradation."

The collapse in veterinarian services also indirectly served the interests of the rich countries: in 1984, Somalian cattle exports to Saudi Arabia and the Gulf countries plummeted as Saudi beef imports were redirected to suppliers from Australia and the European Community. The ban on Somali livestock imposed by Saudi Arabia was not, however, removed once the rinderpest disease epidemic had been eliminated.

Destroying the State

The restructuring of government expenditure under the supervision of the Bretton Woods institutions also played a crucial role in destroying food agriculture. Agricultural infrastructure collapsed and recurrent expenditure in agriculture declined by about 85 percent in relation to the mid-1970s." The Somali government was prevented by the IMF from mobilizing domestic resources. Tight targets for the budget deficit were set. Moreover, the donors increasingly provided "aid", not in the form of imports of capital and equipment, but in the form of "food aid". The latter would in turn be sold by the government on the local market and the proceeds of these sales (i.e. the so-called "counterpart funds") would be used to cover the domestic costs of development projects. As of the early 1980s, "the sale of food aid" became the principal source of revenue for the state, thereby enabling donors to take control of the entire budgetary process."

The economic reforms were marked by the disintegration of health and educational programmes.'3 By 1989, expenditure on health had declined by 78 percent in relation to its 1975 level. According to World Bank figures, the level of recurrent expenditure on education in 1989 was about US$ 4 Per annum per primary school student down from about $ 82 in 1982. From 1981 to 1989, school enrolment declined by 41 percent (despite a sizeable increase in the population of school age), textbooks and school materials disappeared from the class-rooms, school buildings deteriorated and nearly a quarter of the primary schools closed down. Teachers' salaries declined to abysmally low levels.

The IMF-World Bank program has led the Somali economy into a vicious circle: the decimation of the herds pushed the nomadic pastoralists into starvation which in turn backlashes on grain producers who sold or bartered their grain for cattle. The entire social fabric of the pastoralist economy was undone. The collapse in foreign exchange earnings from declining cattle exports and remittances (from Somali workers in the Gulf countries) backlashed on the balance of payments and the state's public finances leading to the breakdown of the government's economic and social programs.

Small farmers were displaced as a result of the dumping of subsidized US grain on the domestic market combined with the hike in the price of farm inputs. The impoverishment of the urban population also led to a contraction of food consumption. In turn, state support in the irrigated areas was frozen and production in the state farms declined. The latter were slated to be closed down or privatized under World Bank supervision.

According to World Bank estimates, real public-sector wages in 1989 had declined by 90 percent in relation to the mid-1970s. Average wages in the public sector had fallen to US$ 3 a month, leading to the inevitable disintegration of the civil administration." A program to rehabilitate civil service wages was proposed by the World Bank (in the context of a reform of the civil service), but this objective was to be achieved within the same budgetary envelope by dismissing some 40 percent of public-sector employees and eliminating salary supplements." Under this plan, the civil service would have been reduced to a mere 25,000 employees by 1995 (in a country of six million people). Several donors indicated keen interest in funding the cost associated with the retrenchment of civil servants."

In the face of impending disaster, no attempt was made by the international donor community to rehabilitate the country's economic and social infrastructure, to restore levels of purchasing power and to rebuild the civil service: the macro-economic adjustment measures proposed by the creditors in the year prior to the collapse of the government of General Siyad Barre in January 1991 (at the height of the civil war) called for a further tightening over public spending, the restructuring of the Central Bank, the liberalization of credit (which virtually thwarted the private sector) and the liquidation and divestiture of most of the state enterprises.

In 1989, debt-servicing obligations represented 194.6 percent of export earnings. The IMF's loan was cancelled because of Somalia's outstanding arrears. The World Bank had approved a structural adjustment loan for US$ 70 million in June 1989 which was frozen a few months later due to Somalia's poor macro-economic performance. '7 Arrears with creditors had to be settled before the granting of new loans and the negotiation of debt rescheduling. Somalia was tangled in the straightjacket of debt servicing and structural adjustment.

Famine Formation in sub-Saharan Africa: The Lessons of Somalia

Somalia's experience shows how a country can be devastated by the simultaneous application of food "aid" and macro-economic policy. There are many Somalias in the developing world and the economic reform package implemented in Somalia is similar to that applied in more than 100 developing countries. But there is another significant dimension: Somalia is a pastoralist economy, and throughout Africa both nomadic and commercial livestock are being destroyed by the IMF-World Bank program in much the same way as in Somalia. In this context, subsidized beef and dairy products imported (duty free) from the European Union have led to the demise of Africa's pastoral economy. European beef imports to West Africa have increased seven-fold since 1984: "the low quality EC beef sells at half the price of locally produced meat. Sahelian farmers are finding that no-one is prepared to buy their herds."

The experience of Somalia shows that famine in the late 20th century is not a consequence of a shortage of food. On the contrary, famines are spurred on as a result of a global oversupply of grain staples. Since the 1980s, grain markets have been deregulated under the supervision of the World Bank and US grain surpluses are used systematically as in the case of Somalia to destroy the peasantry and destabilize national food agriculture. The latter becomes, under these circumstances, far more vulnerable to the vagaries of drought and environmental degradation.

Throughout the continent, the pattern of "sectoral adjustment" in agriculture under the custody of the Bretton Woods institutions has been unequivocally towards the destruction of food security. Dependency vis-à-vis the world market has been reinforced, "food aid" to sub-Saharan Africa increased by more than seven times since 1974 and commercial grain imports more than doubled. Grain imports for sub-Saharan Africa expanded from 3.72 million tons in 1974 to 8.47 million tons in 1993. Food aid increased from 910,000 tons in 1974 to 6.64 million tons in 1993.

"Food aid", however, was no longer earmarked for the drought-stricken countries of the Sahelian belt; it was also channeled into countries which were, until recently, more or less self-sufficient in food. Zimbabwe (once considered the bread basket of Southern Africa) was severely affected by the famine and drought which swept Southern Africa in 1992. The country experienced a drop of 90 percent in its maize crop, located largely in less productive lands." Yet, ironically, at the height of the drought, tobacco for export (supported by modem irrigation, credit, research, etc.) registered a bumper harvest. While "the famine forces the population to eat termites", much of the export earnings from Zimbabwe's tobacco harvest were used to service the external debt.

Under the structural adjustment program, farmers have increasingly abandoned traditional food crops; in Malawi, which was once a net food exporter, maize production declined by 40 percent in 1992 while tobacco output doubled between 1986 and 1993. One hundred and fifty thousand hectares of the best land was allocated to tobacco .2' Throughout the 1980s, severe austerity measures were imposed on African governments and expenditures on rural development drastically curtailed, leading to the collapse of agricultural infrastructure. Under the World Bank program, water was to become a commodity to be sold on a cost-recovery basis to impoverished farmers. Due to lack of funds, the state was obliged to withdraw from the management and conservation of water resources. Water points and boreholes dried up due to lack of maintenance, or were privatized by local merchants and rich farmers. In the semi-arid regions, this commercialization of water and irrigation leads to the collapse of food security and famine.

Concluding Remarks

While "external" climatic variables play a role in triggering off a famine and heightening the social impact of drought, famines in the age of globalization are man-made. They are not the consequence of a scarcity of food but of a structure of global oversupply which undermines food security and destroys national food agriculture. Tightly regulated and controlled by international agri-business, this oversupply is ultimately conducive to the stagnation of both production and consumption of essential food staples and the impoverishment of farmers throughout the world. Moreover, in the era of globalization, the IMF-World Bank structural adjustment program bears a direct relationship to the process of famine formation because it systematically undermines all categories of economic activity, whether urban or rural, which do not directly serve the interests of the global market system.

Subscribe to:

Posts (Atom)